Having waded through the Coronation (mostly, see below), National Cartoonist’s Day, Cinco de Mayo and the Kent State Anniversary, we’re left with today’s demonstration of Wretched Excess, the Kentucky Derby.

Marc Murphy not only reminds us that Derby Day is a celebration of slavery but, in his comments, links to the author of an excellent analysis of Stephen Foster’s ode to the good old days of gay darkies longing for their places on the plantation, and the attempts over the years to clean it up so its meaning is not so obvious.

It’s important to note, as all these wealthy women put on their best Scarlett O’Hara hats and gowns, that this isn’t a sudden realization: The NAACP and others protested Gone With The Wind from the start, and, while Margaret Mitchell was defiant, David O. Selznick did attempt to nudge it away from its most offensive roots.

Meanwhile, the event all these folks primp and pose for has become harder and harder on horses overbred into fragility such that there’s always a good chance the Derby will include a death on the track. Five horses have already died this year in the lead-up to the big day.

What on earth are they celebrating?

Juxtaposition of the Day

Two final thoughts on the Coronation, with Megan Herbert in some way answering the question posed in Harry Bliss’s cartoon.

I doubt that Meghan is feeling any fear of missing out by staying home from the Big Event, though being uninvited is one more intentional slap in the face. However, they’ve had time to get used to things and we can hope that, by the time Will gets his turn to sit in the big chair, things will have mellowed out.

But Herbert’s cartoon also echoes a conversation I had yesterday, in which I said I’ve got nothing against Charlie, who seems like a good fellow, but I wish he’d met some nice American girl who might have deprogrammed him when, like Harry, he’d been young enough to see through the system.

But it’s not like very many of us have had the courage or the vision to step outside our minds and recalculate recalculate recalculate.

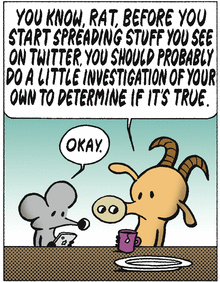

Meanwhile, out in the real world, there are more universal problems, many of them indeed caused by disinformation, and not always filtered through responsible journalism.

For instance, Gary Varvel (Counterpoint) passes on a mistaken interpretation of a shift in mortgage fees that has been so widely reported that I can’t blame him for getting it wrong, though he may have been too eager to seize upon it in order to criticize the Biden administration.

When Varvel posted this cartoon at Counterpoint, he included a note, something I wish more cartoonists would do more often:

President Biden is punishing people with a good credit score, by making them subsidize mortgage loans of higher-risk borrowers with bad credit. This sounds like the communistic philosophy: ‘From each according to his ability, to each according to his needs.”

Which is not entirely unprecedented, but that’s not the point now.

The point, rather, is that, if you searched Google News, that’s what you would find, but the sources for these reports nearly all came from the same side of the aisle.

It took significant digging to find actual analysis of the change. Politifact’s article included the above digest version, and Forbes had a good piece on the topic, but I don’t know if those were even available when Varvel penned his commentary; Snopes is still trying to figure it all out.

Even as someone who covered residential real estate for years, I had to really dig through the facts on this one, and I’m still unsure whether the original reporting was genuine confusion or deliberate disinformation.

But I’ve seen one report explaining that it’s Biden’s fault because he appointed the head of the agency that made the decision, which seems like a deliberate stretch. If nothing else, you can’t accuse him of micro-management at the same time you’re accusing him of senility.

And while I don’t expect cartoonists to understand the inner-math of mortgage financing, I do expect them to look into the current banking crisis more than Chip Bok (Creators) and a number of others have.

You needn’t approve of how the FDIC has stepped up to guarantee larger deposits, but you should grasp the fact that they’ve done it, and that the money used is furnished by member banks and not by taxpayers.

You should also recognize that the three banks that have failed were all in trouble at roughly the same time for the same reasons, and that the reforms made because of them are a reasonable, if not unassailable, protection against other banks falling apart now.

We’re currently at a point where, as FDR said of the Depression, the only thing we have to fear is fear itself. Specifically, banks can still be damaged by panic-inspired bank runs.

Thus you should recognize that this is a good time for everybody to be cool like little Fonzies, and a very bad time for cartoonists and commentators to be whipping up the aforementioned panic.

Kevin Siers seems to have a pretty good grasp of the looming debt crisis, though he offers a descending set of likelihoods:

The trillion-dollar coin dodge is pure sophomore-dorm-at-2-am theory, lovely if you haven’t thought things out and don’t actually know how the world works. In short, it ain’t gonna happen.

And there is, indeed, a clause in the Constitution requiring that we pay our debts, but it seems unlikely that the President could simply invoke it. It would likely have to go to the Supreme Court and, even assuming they’d take it on an emergency basis for a quick decision, the current court is something of a crap shoot.

Which leaves us with either default or cooperation, and cooperation requires that Kevin McCarthy gets the Crazy Caucus to fall into line, which may be as vain a hope as that trillion dollar coin.

One answer, and a good one

I can’t solve the debt crisis or the banking issues, but I’ve got a fix for Derby Day:

Cancel the race, which is only two minutes out of the day and kills the horses. Ditch the antebellum hats and gowns in favor of vintage bell-bottom jeans and gauzy floral blouses. And don’t fuss with fancy mint drinks. Just have cheap beer and crackling rosé on tap free in the grandstands.

And sing the new state anthem, not just at the start but as often as possible until y’all can’t:

You make it sound as if My Old Kentucky Home were written as a pro-slavery song, rather than being, as was actually the case, an abolitionist song inspired by Uncle Tom’s Cabin.

That’s why I offered a link to the expert who wrote the book. Click on it and then click on the stuff you’ll find there.

You’re being far too kind to Gary Varvel. The debate is not focused on bad credit vs. good credit, but on very good vs. excellent credit. To simplify a bit, under the old fee schedule, a credit score lower by 100 points could result in fees that were six times higher. Under the new schedule, the fees may be three times as high (for the same mortgage). There is much more data now about relative likelihood of default under current conditions.. Revising fee schedules to reflect better data isn’t Marxism, as Varvel suggests. (Whether through ignorance or malice.) It’s simply economically rational behavior.

Mike- you have done a great service in publishing that link. The 30+ minute podcast was well worth my time.

In a broader sense, it reflects a truth you frequently remind us of – it’s more complicated. This is the constant challenge for a cartoonist – how to make ones point and be true to that greater truth.

Also, the podcast brought out something else. How Foster may have abandoned his original abolitionist draft to better insure the commercial success of his song.

I have an image of his publisher telling him some version of “that’s not what your audience wants.”

I wonder how many cartoonists, ones that you rightly criticize (Varvel, for example) are in a similar box?

Politifact compares people with 640 credit scores and those with 740 scores. Forbes discusses the difference between people with a 700 and a 760 or 780 score but tracks as low as 630, while Snopes is less specific, but uses 720 and 780 as markers. I will concede that, among the conservative commentators — who have, so far, focused the debate — they may frame it differently, but they also have suggested that Biden himself was behind the changes. Res ipse loquitur.

Dear Mr. Peterson, you said, “the money used is furnished by member banks and not by taxpayers.”

While that is superficially true, it is a know fact that all the banks will pass the increased FDIC fees on to customers (taxpayers) through reductions in savings interest and increased fees and charges. Please, don’t let the Fumbling Fed and the Banksters off the hook.

I don’t buy the Chaos Butterfly Theory of Economics. Obviously, all costs of everything eventually land on the consumer, but it’s unfair to suggest that this particular cost has that particular effect. If someone in the office at Wells Fargo has a cup from the breakroom coffee pot, the cost will filter down to each depositor, but it won’t show up on their bank statements as a separate entry.

Sherman, by that logic, if the cost of whatever Huggies are made of goes up the cost is borne by taxpayers. I’m a taxpayer, I don’t have any need for Huggies, and whatever they cost has no effect on me.

While most bank customers are taxpayers there are plenty of taxpayers who aren’t bank customers in this context. They don’t have any money in deposit-insured accounts.

Dear Mr. Peterson, I understand your point. But, the FDIC payments for big banks are millions of dollars per year. I am a member of credit unions, I don’t use banks partly because a friend, who was a bank V.P., related to me how they DO raise fees, etc. (and try to hide them on statements) for many reasons: to cover the huge cost increases whenever there are losses due to FDIC increases or their massive risky investments ‘tank’ or to obscenely compensate executives or favored huge investors.

Lonny Groseed said ‘ there are plenty of taxpayers who aren’t bank customers in this context. They don’t have any money in deposit-insured accounts.”

I reply, You are correct. But, sadly, that is almost always because half of americans live hand-to-mouth and don’t have bank accounts. That says a lot about our society.

At this point, I must just thank Mike Peterson for all the insights he provides here.

Why is the easy obvious solution repealing the 2017 tax cuts for the wealthy and “corporate individuals” and instituting heavier taxes on these “individuals” both actual humans and corporate entities always overlooked?

Had the previous administration, not only reduced federal revenue while going on a spending spree they wouldn’t of had a 25% to the national debt in four years

Why don’t they repeal the 2017 tax cuts?

Because to many conservatives, taxes are EEEEEeeeeeeeevil!!!

And apparently they think it’s better to starve the children than it is to get a second job.

Sorry I missed it.

https://apnews.com/article/kentucky-derby-churchill-downs-horses-death-died-131a825cc0dc7626ee1e59ca91637ab0