No need to wait for the cartoons about yesterday’s Jan 6 Committee hearing to arrive; Jack Ohman had picked up on the scandals and ass-covering of the Secret Service that morning, though I doubt he knew ahead of time the ghastly array of uninvestigated warnings that would be displayed at the hearing.

I’ve often said that I don’t mind information-gathering because my experience in the Sixties was that they didn’t know how to sort through it. But the level of warnings that the Secret Service received before the insurrection goes well beyond that, particularly in tandem with the convenient loss of all texts on all SS phones from the period of the riot.

You don’t have to be a prophet to read the writing on the wall. You just have to have been around the block a few times.

set your expectations at “not too high.” It’s not that they won’t unveil the goods, but what have you seen in the past few years to make you believe anyone who wasn’t already convinced will change their minds?

This morning’s Reliable Sources Newsletter confirmed the no-surprise response.

And if that weren’t enough to prop up my ego, here was what I offered as a rhetorical flourish:

We haven’t seen the full response yet to the jury award in the Alex Jones case, but there are already conservatives defending him, and the only shock would be if they responded to this “Have you no sense of decency?” moment by acting as if they did.

But these days, hyperbole, exaggeration and out-and-out insults seem to be taken as a challenge:

“The Regime.” (snrk)

I note all this less to say “I told you so” than to point out that there is no moment of total victory in the battle against hate, lies and authoritarianism.

And if they get an edge in November, and particularly if the McConnell Court upholds their fascistic theory granting state legislatures the right to overturn election results, it will be a long slog back to democracy.

So it’s good that Jones got hammered, though the award is likely to be pared down a bit, and it’s also good that SCOTUS unanimously turned down Dear Leader’s appeal of a lower court ruling on the Mar A Lago search, and, boy howdy, the Jan 6 Committee laid out absolute proof of Trump’s role in planning the attempted coup.

But as Yogi said, it ain’t over ’til it’s over.

And it sure ain’t over. It’s not even Churchill’s “end of the beginning.”

There is, as Tom Tomorrow suggests, no level of proof or logic or plain common sense that will deter the True Believers not simply from clinging to their delusions but from parading them as obvious facts that only they are smart enough to understand.

There is, as Tom Tomorrow suggests, no level of proof or logic or plain common sense that will deter the True Believers not simply from clinging to their delusions but from parading them as obvious facts that only they are smart enough to understand.

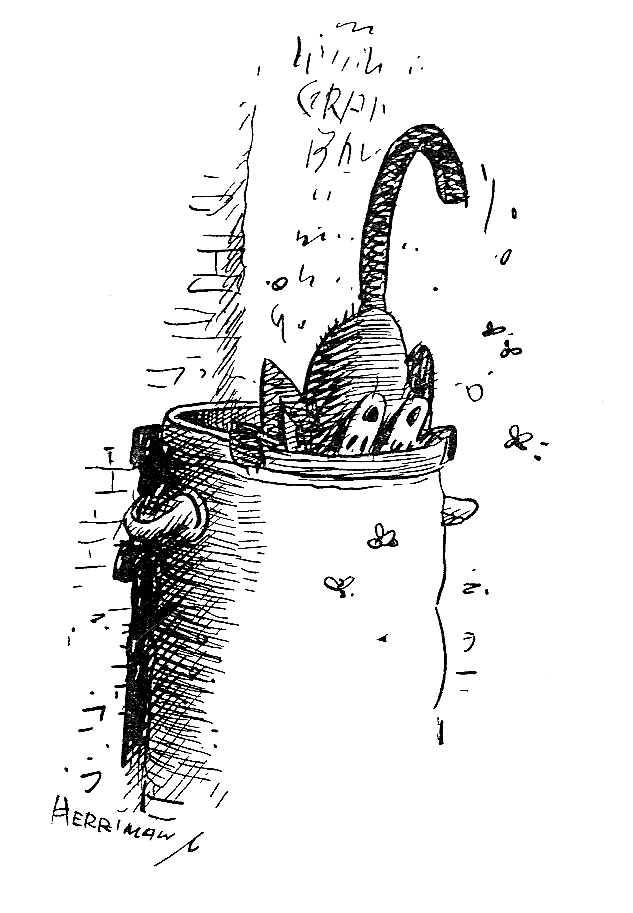

At least Michael de Adder can offer a giggle. The move to subpoena Trump is not, itself, farcical, though even if he fails to drag it out until the committee disbands at the end of the year, and even if he shows up, he won’t testify.

Sane normal people will see that as confirmation of his guilt, which they don’t need anyway, but his loyal followers will see it as more proof that JFK Jr is plotting against America in the basement of that pizzeria.

The subpoena was an important move. Leaving an historical record matters. But even if you are enough of a mooncalf to think it’s going to result in frank testimony, you can’t possibly believe it will happen before the midterms.

We’re gonna have to show up in numbers on November 8.

Oh well. Let’s go be depressed about something else.

John Deering (Creators) takes a dim view of Jerome Powell’s analysis that wages are too high, though you’ve got to give Powell credit for finding a way to make it all our fault.

The notion of cutting wages reminds me of the 1894 Pullman Strike, when they cut wages without cutting rents in Pullman’s model town, and required employees to live there. It touched off a massive national strike that I don’t think Powell envisions as part of his path to economic recovery.

Deering does well to draw a dozen customers and two employees, because businesses are struggling to find enough people to make things work, and you’d better check your gas gauge before sunset, because even the 24-hour convenience stores are shutting down for lack of help.

It’s not clear how antagonizing the few employees we’ve got is going to fix anything.

Meanwhile, Chip Bok casts a disapproving eye on policies that could bring down the value of 401k’s, and I’m torn between sympathy and wanting people to make sacrifices to get us back on track.

I’m retired and so converted my 401k to an IRA so I could withdraw money from it to supplement my Social Security. And my IRA has gone down 12.5% since January.

That’s the “right now” element.

By contrast, the rule with a 401k is to leave it alone and, by the time you need it, it will likely have recovered, or it will at least be in the same proportion to the surrounding economy then as it was before.

My first 401k was a replacement for a pension system, and they offered a 2-for-1 match on our contributions. Which they then dropped to a simple match. Which they then dropped entirely, converting us in the space of five years from a pension plan they financed to a piggy bank that cost them nothing.

But the problem is ungrateful workers who should be paid less. Trickle up.

Joe Heller notes that the retirees’ Social Security increase is being gobbled up by inflation. Well, we’re all being hit by inflation.

The annual cost-of-living increase is based on third-quarter consumer prices, so, sure, it’s based on inflation this year, and we won’t see the 8.7% boost until January.

My take is that it’s been pretty rough these past few months, but I’ve learned to live on that tight budget, and, assuming inflation continues to go down, the extra $130 or so per month is gonna let me ease back a little on the beans-and-rice.

And if inflation doesn’t ease, we’re all screwed anyway.

The real cause of inflation can be found in the obscene profits corporations ate

At the moment, the only western G20 countries with a lower inflation rate than the U.S. are Switzerland, France and Canada. Mexico, U.K., Euro, Germany, Italy, Spain, Russia and the Netherlands are all higher. (from tradingeconomics.com)

So while the Fed’s attempts to control inflation may or may not be warranted, the pull on the dollar from interaction with all those other economies can’t be ignored.