We’ll start the day with a pair of cartoons about a topic I’m not going to cover yet, though I did touch on SVB’s collapse the other day.

At the moment, we’ve got people who should understand this stuff saying that SVB’s fall is because of changes in the Dodd-Frank law, and Barney Frank saying he supported those changes, and others saying it’s because the banks began hiring minorities and investing in socially responsible companies, and others saying it’s the first of a series of collapses and we’re all gonna be ruined.

Which brings in Joy of Tech’s comparison to people stockpiling toilet paper. I got an electronic note on my bank’s website saying “Chill. We don’t do any of what they were doing” and they’ve always played straight with their depositors before.

Also, cartoonists are not economists and neither are most reporters and, basing my own analysis on the little I learned in 20 years of business writing, I’ve seen enough “Often in error but never in doubt” takes on such things that I’m going with Jeff Stahler and just hanging back and hoping for the best.

And bracing for all the roller coaster cartoons.

But I will comment on Zits (KFS)‘s current story arc, because it certainly is easy to obtain credit and our consumer economy is strongly based on people spending more than they earn. Jeremy is at a stage of life where he’s poised to learn about “wage slaves” and Sisyphus and maybe we should call this “Birth of a Salesman,” because he’ll soon be out there riding on his smile and his shoe shine, trying to keep up with it all.

At least he had to apply. When I was a young lad, credit card companies made the astonishing mistake of sending out unsolicited credit cards to college students, which I guess netted them some new customers. But what I mostly saw was that it netted them a lot of kids swapping cards and then denying the charges.

I seem to remember that they passed a law against it, but I’m not sure they needed to, since it was like passing a law against hitting yourself in the face with a hatchet. The sum total of beer, pizza and gasoline that went on those swapped cards must surely have canceled out any benefit of the act.

And here’s the thing, O Best Beloved: This was back before computerization, when merchants submitted credit slips for reimbursement and didn’t know they’d been ripped off until a charge was rejected by a distant company.

They got a booklet of bogus numbers each month and were supposed to check the card against those rows and rows of tiny print. For anything under 30 or 40 bucks, they generally didn’t bother.

You could buy a fair amount of beer and pizza, or fill your car’s tank, for a lot less than $30, and then say “What card? I never got a card. Someone must have stolen it from my mailbox!”

I’m not familiar with the Ferry Ticket Laws of Snug Harbor, though, as seen in today’s Wallace the Brave (AMS), I assume there is some kind of regulation or local rule involving age.

I’m also willing to bet that some ticket sellers are sharp-eyed and others are willing to overlook the fact that your alleged father has Velcro closures on his shoes. I just had a conversation two days ago with a fellow who had his draft card confiscated by a bouncer who noticed that the birthdate had been altered.

The laugh being that he was, at the time, 21 and the card had been changed some time before he’d reached the magic drinking age. Well, it’s a laugh 50 years later. Probably wasn’t so funny back then.

Getting back to Jeremy and his new credit cards, we can assume that he’s 18, since he’s been applying to colleges, though that happens awfully early in senior year, if not the spring before.

But, to go back again to Ancient Times, I took a course in Business Law in which the professor regaled us with stories of local car dealers who sold cars to Air Force Academy students and then had to eat the contracts because the Zoomies were under 21, which was then the age of majority, and couldn’t be held to them.

(Though, having lived in a military town, I suspect that ducking out on a contract would not enhance a young officer’s career prospects, assuming the aggrieved dealer ran it up the chain of command.)

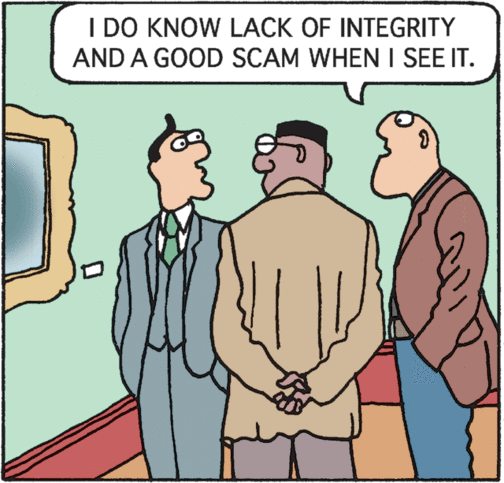

Perhaps, like Stan, the detective in Pros and Cons (KFS), I’m just becoming too suspicious. Or perhaps, like Stan, I’m becoming too perceptive.

This cartoon, for some reason, reminds me that Facebook and Instagram are moving away from NFTs, according to Techcrunch (with a h/t to Reliable Sources).

And nice timing on Sunday’s Edison Lee (KFS), because Monday morning I saw an article on where I could stream all the Oscar-winning movies and the answer was “Subscribe to everything.”

Which ain’t happening.

Finally, if you’ve been fretting over the potential destruction of all meat-puppet life if AI becomes sentient, Existential Comics offers a different outcome. I don’t know that it’s more positive overall, but I’ll accept it as a solution to that particular problem.

Meanwhile, while the experts sort out SVB, here’s all you need to know about economics:

Another note about the days when merchants submitted credit slips for reimbursement and were looking up all those numbers in the monthly booklet (I’ve done it!): There weren’t cameras everywhere! You weren’t going to get nabbed because the store didn’t have footage of you making the purchase.

As is often the case, science fiction was there first. This Existential Comics episode reminds me of Isaac Asimov’s story “All the troubles of the world,” published in 1958. An overly-detailed summary can be found at https://en.wikipedia.org/wiki/All_the_Troubles_of_the_World.

Hey, MY dad has Velcro closures on his shoes.

The kid in Wallace the Brave just needs to pretend he’s an arthritic great-grandfather.

MAYBE you were being asked if you wanted to subscribe to the winning movie, Everything Everywhere All at Once, but the title was truncated to Everything.

I am 71 years old, and all of my shoes have Velcro closures (or are loafers), except for one pair of dress shoes. Velcro is quicker than laces and easier to adjust the tightness.

At my age, I feel no need to prove to anyone that I know how to tie a shoelace.

I remember when merchants had to make a telephone call to verify your credit card for any purchase over $50. I got a deal on a lamp once because the merchant lowered the price to under $50 so he wouldn’t have to make the phone call.

I worked in a Waldenbooks back in the 80s and remember those lookup books and phone calls well, At least twice (I remember) having to call for a purchase over $50 and having the credit card company tell me to cut up the card in front of the customer and send it back to the bank (which I did, to the horror and anger of the customer). What fun times!